Oncology is one of Ipsen’s three core therapeutic areas, and the company has been actively striking deals that add cancer drugs to its portfolio and pipeline. The latest deal brings its first antibody drug conjugate. While the ADC space has become crowded and competitive, the ADC coming to Ipsen is engineered with technology that the drugmaker believes could set it apart.

The ADC is from Sutro Biopharma. According to deal terms announced Tuesday, Ipsen is committing to $92 million in near-term payments, including an equity investment in publicly traded Sutro.

Clinical-stage Sutro is an ADC specialist, developing drugs with features and properties that give them advantages over currently available ADCs as well as some ADCs still in development. Ipsen is getting global rights to STRO-003, a Sutro ADC engineered to target ROR1, a tumor antigen that’s overexpressed in many different types of cancer, both solid tumors and blood cancers. While ROR1 is a validated target, there are no FDA-approved drugs that hit it.

An ADC is comprised of a tumor-targeting antibody that’s chemically linked to a toxic drug payload. Sutro engineered STRO-003 with its platform technology that enables the conjugation of the linker and drug payload at specific sites on the antibody. In addition to improving an ADC’s therapeutic benefit, Sutro says its technology results in a more stable ADC, which should help ensure that the drug payload is not released prematurely.

Sutro has said in regulatory filings that it believes STRO-003 has the potential to be the first and best-in-class among ADC drugs targeting ROR1. The company was preparing to advance this ADC into the clinic for the treatment of solid tumors, including triple negative breast cancer, non-small cell lung cancer, and ovarian cancer.

With STRO-003 heading to Ipsen, the Paris-based drugmaker joins a small group of companies also pursuing ROR1 with ADCs. Merck’s contender comes from its $2.75 billion acquisition of VelosBio in 2020. That drug candidate, zilovertamab vedotin, has reached Phase 2 testing in blood cancers. Last year, CStone Pharmaceuticals began a Phase 1 test of its ROR1-targeting ADC, code-named CS5001. Boehringer Ingelheim added a ROR1-targeting ADC to its pipeline via the 2020 acquisition of NBE Therapeutics. But that study was terminated last September. Meanwhile, Lyell Immunopharma’s lead program goes after ROR1, but with a CAR T-therapy.

Cancer is the biggest driver of Ipsen’s sales, accounting for more than €2.3 billion of the company’s €3.1 billion in revenue in 2023. Some of that growth comes from newly acquired assets. In 2017, Ipsen paid $575 million up front to acquire Onivyde, a Merrimack Pharmaceuticals drug approved for treating advanced pancreatic cancer. In February, Onivyde won FDA approval as a first-line pancreatic cancer treatment, which expands the market for this therapy. Ipsen’s $247 million acquisition of Epizyme in 2022 brought an FDA-approved treatment for follicular lymphoma. Ipsen has also pursued R&D deals, such as its R&D alliance with T cell receptor therapy startup Marengo Therapeutics. On Tuesday, the partners announced the nomination of the first of two drug candidates covered by the multi-year pact.

Under the terms of Ipsen’s agreement with Sutro, the French drugmaker will assume responsibility for Phase 1 preparation, including the submission of an investigational new drug application to the FDA. Ipsen will also handle all clinical development and commercialization. The financial structure of the deal does not have a straightforward upfront payment. According to a Sutro regulatory filing, the license fee that Ipsen is paying is $50 million. Ipsen is also purchasing about $25 million worth of Sutro shares. Achieving a specified developmental milestone would trigger a payment of up to $7 million. If that happens, Ipsen must purchase up to $10 million worth of additional Sutro shares.

Additional development and regulatory milestone payments could add up to $447 million, but that assumes progress in multiple indications, according to the Sutro filing. If the R&D leads to commercialized products, the deal includes another $360 million in payments tied to sales milestones as well as royalties from drug sales.

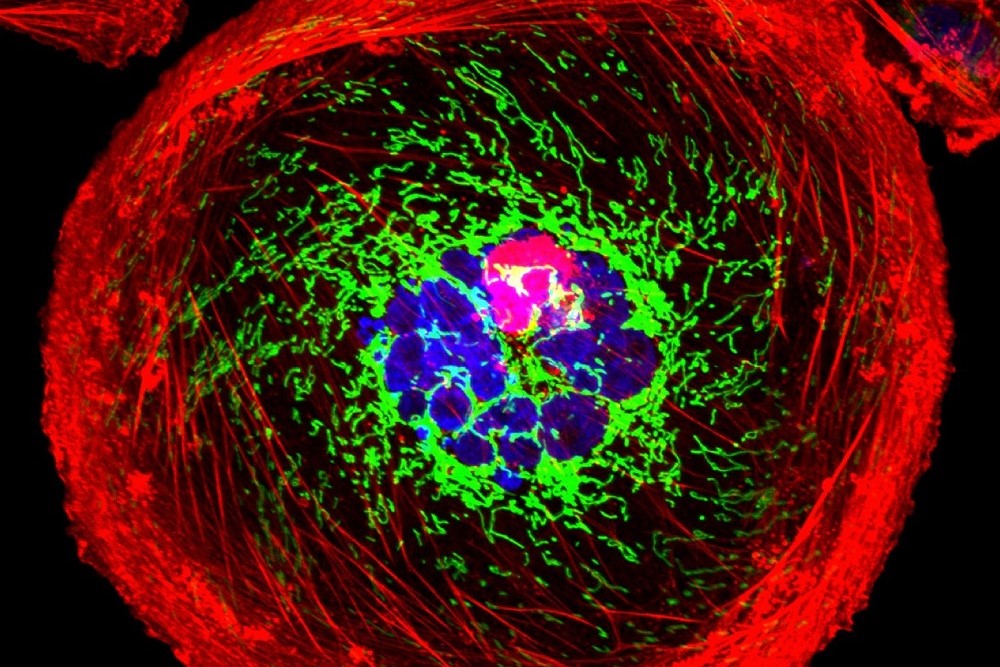

Public domain image by the National Cancer Institute